As the housing market tightens, everyone wants to know about tomorrow’s housing. Specifically, they want to know who is building what, and where they are building it. That data, and the analysis to go with it, is now available. Source: IndustryEdge

The good news is, its available for each state, broken up to each region, not just Capitals, and even down to the suburb level. We can get down to building type, and even drill into details about who is funding the building.

Our initial analysis has identified expansion suburbs in Sydney, and how many dwellings will be built. We know how many are houses and how many are each type of multi-residential dwelling.

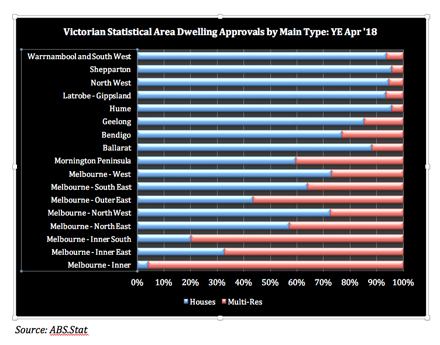

The chart below shows another of the outputs of that analysis.

It displays Victorian dwelling approval proportions for high-level regions. The split is between houses and all forms of multi-residential dwellings. In its own right, this data provides some points of interest, but to be clear, it only scratches the surface.

Who knew for example, that in Melbourne’s outer-East, multi-residential dwellings were being approved at close to twice the pace of free-standing houses over the last year?

When we drilled into the detailed suburb level data, we could see which suburbs, and exactly what multi-res dwelling formats are being approved. (Hint: it isn’t massive apartment towers and it isn’t small blocks of flats either)

Then, when we looked at the maps, we could see why that was happening.

And this is just the beginning. The chart above barely touches the sides of the options available to drill down into Australia’s dwelling approval data. We cannot quite get to the specific dwellings yet (what gets built on each street and house block), but we can now go suburb-by-suburb for every local government area and region in Australia.

What is more, we can also drill into infrastructure and other developments that are being approved at this detailed level. From a predictive point of view, as well as a project opportunities perspective, we can show which areas are receiving what infrastructure, including ahead of other dwelling approvals.

It is true that without computing power, this is somewhat laborious work. That is why our team is working through system automations to allow us to do the rapid, timely and cost effective analysis of this data that is needed in fast-moving markets.

Need to know more? Feel free to contact us at [email protected].

Every month, IndustryEdge publishes Wood Market Edge, Australia’s only forestry and wood products market and trade analysis, and supplies its customers with hundreds of unique data products, advisory and consulting services. Find out more at www.industryedge.com.au