The timber and prefab sector is set to kick goals again this year if a raft of ambitious projects gets the go ahead, among them one of the biggest commercial timber building in the world by volume. Source: The Fifth Estate

Adam Strong, group managing director of prefab timber powerhouse Strongbuild, is expecting a year of continued growth in 2018, with little if any negativity from the market slowdown already apparent towards the end of last year.

The company has a “good pipeline of work”, and industry-wide he doesn’t see the sector slowing down anytime soon.

“What we do is choose the right project to add value to. A lot of people are coming to us. “We’ve got a strong line of clients. They’re quality clients, like [retirement operator] Aveo, Mulpha, Frasers, Stockland and [Anglican church retirement operator] ARV.”

In fact, the construction slowdown, which his forecasts say could be about 20% by volume, might well be of benefit to the sector, releasing trade skills and taking off some of the pressure from the recent boom.

Besides, timber and prefab is a niche sector and it’s only just starting to properly take off.

Developers and builders are starting to grasp the ease and benefit of these solutions, Mr Strong says, none more so than the education sector in NSW where former planning minister and now minister for education Rob Stokes late last year announced a $4 billion program to replace demountable classrooms with prefab timber structures.

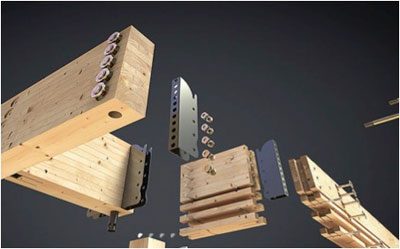

Breakthroughs in the sector include stair and lift shaft now built in cross laminated timber, or CLT, and closed panel walls, or panellisation, meaning pretty much the entire wall including fitted windows and doors can be pre-made at the factory and sent out as a flat-pack.

“We’re making all those in our factory and they’re going to site as closed panel walls,” Mr Strong says.

“I feel this solution is the sweet spot for apartments up to six floors. So medium rise, affordable apartments projects. It’s much more competitive.”

Savings can be up to 5%, he says, pointing out that can be big dollars on a project of, say, $45 million.

Plus there is the potential to shave up to four months off construction time. And if the logic of speedier onsite construction, less waste and the potential for cost savings isn’t enough, then three particularly ambitious projects slated for Sydney this year will likely tip over remaining sceptics.

One of these will be a commercial timber building that could well be the world’s biggest by volume.

Another will be a 13-storey hotel atop a four-storey existing building and another a project by one of the universities. According to Mr Strong, “if a building is designed to take another six floors of concrete structure on top, it will probably take 10 in timber”.

In house Mr Strong expects his company could well keep up with the 30% annual growth in both turnover and staff numbers – now at around 170 – of the past five years, but his preference is to consolidate and bed down processes and quality control at the company’s prefab factory at Bella Vista.

Once that occurs the factory may start up a second shift to ramp up production, taking in work from other sources.

“We’re now 7am to 3.30pm but it can operate 24 hours a day. Our plan is to open a second shift and to double operations,” he said.

“There are a few people we’re already talking to from a building point of view, non-competing entities… it will help even out the peaks and troughs.”

Industry wide, growth will continue this year, he says, but it will be more moderate. “I don’t think there are too many rocky builders.

Everyone is expecting a little bit of a downturn but education and commercial are starting to pick up particularly in NSW and Sydney, and the economy is very strong.

“It might come off 20% in terms of construction volumes – that’s what we’re looking at – but it could be a good thing for the markets: we’ll get some trades back.”

Spotlight the timber building industry and Mr Strong says it’s a different story.

“The market will be surprised at the number of timber projects and even prefabricated ones that will hit the market in the next 12 to 18 months, and realise this is here to stay.”