The 2022 Appita Fibre Value Chain Conference series focussed on how best to create new value and improve the integrity of the supply or value chain. A major element of that was a dedicated and stand-alone Supply Chain and Innovation Forum. Source: IndustryEdge

Speakers from chemicals supplier Solenis (James Zhu) and in particular, Linda Venables the Head of Supply Chain for PwC, were informative and joined for a very lively panel discussion by Murray Horn, the General Manager of Oji Fibre Solutions’ Lodestar and Timo Arra from Tietoevry Industry, a solutions provider.

Panellists spent some time discussing the breadth of the term ‘supply chain’ and the fact it is more complex than pure logistics. Inevitably however, there was plenty of discussion in the panel session chaired by IndustryEdge’s Tim Woods, about shipping companies, the importance of ports and infrastructure and the challenges of keeping containers, pallets and other shipping materials in balance.

Recognition of the disruption to globalised supply chains came early in the forum, with various examples, including:

- Trans-shipping delays (where containers are offloaded from one vessel in a major port, only to be delayed onto the smaller vessels making the final delivery)

- Shipping containers and timber pallets being held in one port or country for longer than expected, reducing availability in other ports and countries and slowing down trade

- Specific fuel disruptions and challenges switching shipping labour forces.

As Murray Horn outlined, the flexibility and reliability provided by a company operating some of its own vessels (OFS Lodestar has two bulk vessels on long-term lease) assisted OFS to meet customer commitments, especially during the darkest days of the pandemic.

A lively discussion on container back-loading was concluded simply, with the proposition that if a business has the right relationships, it can reduce its costs by creating ‘circular leases’ for containers.

The discussion on relationships and supply chain integration was led by Linda Venables whose extensive experience led her to the conclusion that successful supply chains are almost always the outcome of successful relationships. That might mean different things for different businesses, but always includes sharing needs and interests and moving beyond the transactional.

For businesses on the supply-side (all businesses are suppliers to someone, of course), diversification to ensure consistency of supply was considered an important element of the future. As James Zhu advised, it was an approach used by most major chemical suppliers, even those with quite local production and supply arrangements.

The need to conduct scenario-based risk assessments was a theme of this forum, with the view that no matter how many scenarios are covered, something unexpected can always arise. As Timo Arra explained, the best predictions will come from data analysis and digital predictions as simple as understanding vessel movements and as complex as digital ledger technology, shared in open forums between supply chain participants.

There are very few activities that cannot be improved with better and more open information. As James Zhu outlined, understanding customer needs, by constant discussion, is important to ensure materials are in the right place, at the right time.

All these activities add costs throughout the supply chain. While they are inevitable, it was a clear and shared view that increased costs for materials and goods are likely to be locked into the future – and dealing with that will also require better collaborations throughout the supply chain.

As the Forum concluded, the panellists agreed there are several features common to all modern supply chains:

- They are more complex and increasingly unique

- Unexpected events are more likely and their impact is less predictable

- Participants need to plan in a manner integrated to their business plan and conducted in collaboration with supply chain partners

- Partnering is the key to success and building resilience in the supply chain

- Technology can drive supply chain visibility and create opportunities for new partnerships.

Market balance under examination

In what is fast becoming a tradition, IndustryEdge provided the regional market overview for the conference series, summarising material in the 2022 Pulp & Paper Strategic Reviews.

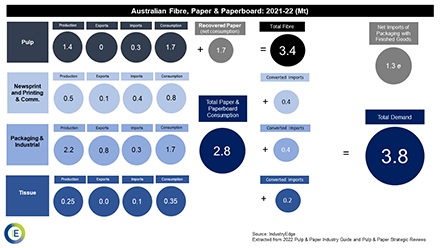

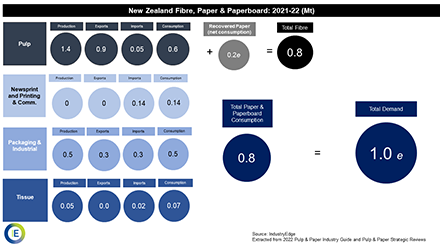

If there is a similarity in the trends for Australia and New Zealand, it is the increasing importance of packaging and industrial grades of paper and paperboard to total consumption. In Australia, the proportion is around 61% and in New Zealand, 62.5%. The influence of packaging is growing in both countries.

For differences, we can look to the production profiles. In Australia, production of printing and communication papers, including newsprint, continues and is essentially the regional volume. By contrast, there is no production of these grades in New Zealand any longer, but there is significant pulp production for exports.

The graphic below shows Australia’s production and consumption profile for 2021-22.

Although the data is quite different, the graphic below sets out the experience of the New Zealand industry on the same format.

Actively discussed during and after the conference was the role of Indonesia as the major recipient of both country’s recovered paper. Indonesia was long the major customer of the New Zealand sector, but it is now the same for Australia, since China exited the market.

For more information visit: www.industryedge.com.au