Prices for all of the main pulp grades rose in December, in nearly all markets, with the main Chinese market expecting further price increases in the first quarter of 2022. Delayed deliveries from South America, and from Russia, have tightened supply. Source: IndustryEdge

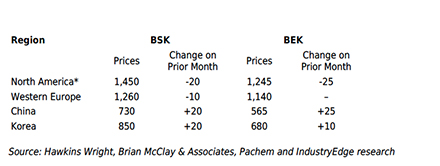

In China, the Bleached Softwood Kraft (BSK) price lifted USD20/t to an average USD730/t. Bleached Eucalypt Kraft (BEK) prices added an average USD25/t to lift to USD565/t. The differential between the two pulps narrowed to USD165/t, significantly higher than the long-term average.

In China, because of soft shipments and low port stocks, Hawkins Wright reports that the local resale market has retained a premium over imported prices struck in US dollars. That will be inflationary for the sector in the near term.

Scandinavian pulp mills face industrial action that will further soften supply, until settlements are reached. For some pulp buyers in the local Oceania region, that has contributed to efforts to secure additional shipments and to expand local inventory – especially in the tissue sector, where any supply disruption is intolerable. Though it seems a long time in the waiting, as with the pandemic itself, the supply chain challenges it has presented will also pass.

When that occurs – we own no crystal ball – one factor that will be front of mind is how the global industry will accommodate the significant new capacity that is scheduled to come on-line in 2022 and over the next few years.

The consensus is that from a market pulp perspective, new BSK pulp projects will add around 0.7 Mt pa capacity through to 2025. That seems manageable.

The addition of something close to 7.2 Mt of BHK pulp capacity may well be a different matter. Much of that will be in South America and the majority will be targeted to supply the non-integrated paper manufacturers in China. From 2H22, as the new mills are completed in South America, it has to be anticipated the market will be faced with a period of over-supply, which can be expected to lead to price deterioration.

In China itself, new market pulp options from South America will be attractive to paper manufacturers, but the ability of the Chinese pulp producers to respond may depend on their ability to compete.

Unlike the South Americans, Chinese pulp mills import fibre (mainly from Vietnam and Australia in the case of hardwood supply) and have proven themselves less able to attract capital and scale over the last decade.

That said, in China, new projects are focused on delivering something like 3.0 Mt of additional pulp capacity by the end of 2022. Some are still proposed and not being built, but several are proceeding and coming online.

New Chinese projects will be challenged by the additional South American supply. Semi-Chemical and Unbleached Kraft pulp capacity is also anticipated as part of the industry’s significant investment cycle. 2022 shapes as a year in which new pulp capacity will challenge market balances and pricing.