The rise in the cash rate is hitting the Sydney and Melbourne new home markets the hardest, according to the HIA’s Chief Economist Tim Reardon. Source: Timberbiz

HIA has released its economic and industry Outlook report which includes updated forecasts for new home building and renovations activity nationally and for each of the eight states and territories.

“The RBA’s rate increases are yet to adversely impact the lagging indicators of economic activity like unemployment or inflation, but they are impeding future home building activity,” Mr Reardon said.

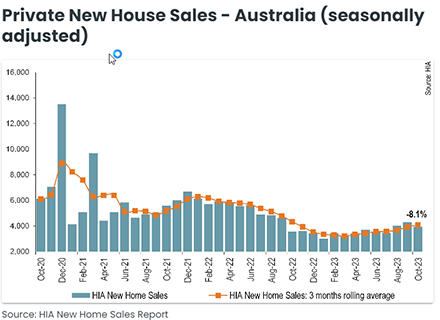

“Leading indicators of home building activity including approvals and lending have fallen sharply, to decade lows, and have remained at these levels for most of 2023.

“This will flow through to a significant slowdown in detached home building in 2024, producing the lowest level of new commencements in more than a decade and keeping apartment construction suppressed,” he said.

This low volume of new home commencement was at odds with the goal of increasing the supply of housing stock, especially in the tight rental markets of Sydney and Melbourne.

Mr Reardon said that the higher costs of delivering a new house and land package, or a new apartment, in Sydney and Melbourne was resulting in a greater impact from the rise in the cash rate in these areas.

“Interest rates helped drive a boom in building through the pandemic and a return to a stable market isn’t likely given the subsequent rise in the cash rate,” he said.

“House building activity is set to slow in all regions, except for Western Australia, under the weight of rising interest rates.

“There remains a significant volume of building work still to be completed and as this occurs, home building will drag on economic growth and push unemployment higher.”

Mr Reardon said that the cost of building materials and labour was stabilising on this side of the pandemic, but they were not likely to fall substantially.

“Increasing the volume of new homes commencing construction against the rising cost of borrowing will require governments to lower the cost of shovel ready land, attract more investment especially from overseas and reduce tax imposts,” he said.

Detached houses commencements declined in 2022/23 to 109,890 which is 22.1% down from the 2020/21 peak. Detached house commencements are expected to decline by a further 10.9% in 2023/24, which will represent the weakest year since 2012/13. Commencements are expected to remain stable in 2024/25, before recovering modestly in the subsequent years and exceeding 110,000 by 2026/27.

Multi-unit commencements also declined in the June Quarter 2023, this produced a total of 62,290 starts in 2022/23, the weakest year since 2011/12. This year is barely more than half the annual peak during the 2015-18 apartment boom. Multi-unit commencements are expected to bounce back by 22.3% to 76,160 in 2023/24, and another 19.0%in 2024/25, remaining above 90,000 for the remainder of the forecast horizon.