Pulp price sentiments softened towards the end of October, with demand and supply fundamentals beginning to impact prices. The issue for the upstream supply chain – including the supply of woodchips from Australia – is that softening pulp prices may place woodchip prices under pressure, in the short term. Most significantly, softening of Chinese manufacturing output, linked directly to a fall in export orders, appears to have reduced demand for the major global pulps. Source: IndustryEdge for Timberbiz

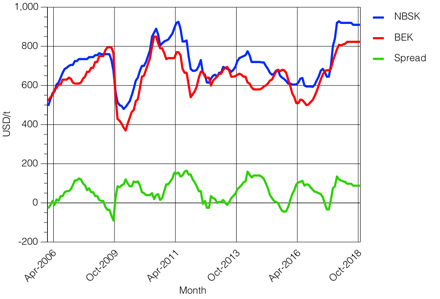

Chinese Chemical Pulp Market Prices (USD/t)

Source: Hawkins Wright

In October, Bleached Softwood Kraft pulp (BSK) prices averaged USD910/t in China, stable compared with the prior month. However, November trades involving major suppliers from Russia, Chile and Canada were inked at USD30 – USD40/t lower according to the authoritative Hawkins Wright.

In part, the shift in the Chinese market is a reflection that discounted local currency pricing was unsustainable. Suppliers recognized they needed to share the discount to maintain volumes, and lowered their prices.

The fall in Chinese export orders is flowing on to impact intermediate goods like pulp, as well as raw materials, that include coal, iron ore, woodchips and logs. Impacts will typically be felt for intermediate goods before raw materials. That appears to be the case with Chinese demand for pulp, as well as capacity to pay, because of declining prices for most grades of paper and board.

The situation is not markedly different for Bleached Eucalypt Kraft (BEK) pulp, although the grade may be lagging the experience of BSK by a few weeks. Average BEK prices remained at USD920/t, with softness experienced for other hardwood grades and among smaller suppliers. Larger suppliers will hold out for some short while, but their prices can be expected to contract in coming months.

Pulp demand remains strong, globally, for the present, but there are indications of contraction in what has been a solid and expanding market for most grades of paper and board over the last year.

This analysis was first published in the monthly Pulp & Paper Edge, Australia’s only analysis of fibre, pulp, paper and paper product markets. This material is syndicated by agreement with IndustryEdge.