Around the world, commodity prices are high because supply is uncertain and stressed supply chains are denuded of inventory. As consumers of pulp rush to ensure they meet their minimum needs – let alone replenish their inventories – pulp prices continued their upwards rise in May. Source: IndustryEdge

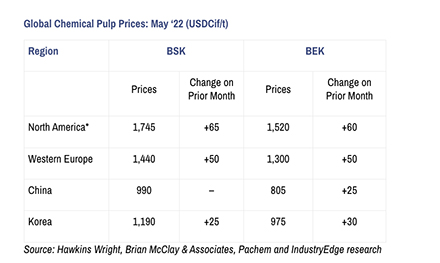

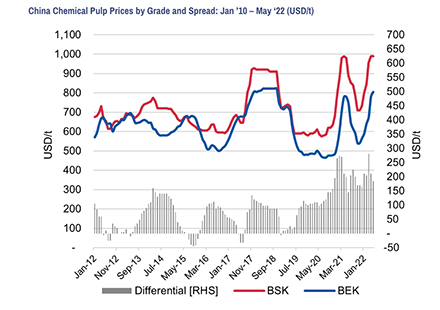

For all the pressure, in the main Chinese market, Bleached Softwood Kraft (BSK) pulp prices remained at their all-time average high of USD990/t. The BSK price may have topped out.

The Bleached Eucalypt Kraft (BEK) price lifted a further USD25/t to USD805/t. The hardwood pulp price is still short of the record USD823/t achieved from April to October 2019.

The ‘differential’ between the two pulps has narrowed to USD185/t but is still large as the chart shows. The spread typically dictates points of substitution between pulps and eventually, between grades of paper in some cases. Tightness in pulp markets is evident when despite the price pressures, substitution is not rife.

Our prediction remains that pulp prices will sustain these levels for at least several months.

IndustryEdge has been asked recently to consider what conditions could see the pulp price fall, and when that might occur.

Obviously, the supply-chain disruption is a key element right now, so first, we consider without the disruptions, the pulp price would be significantly lower.

The reason for our view is that paper prices would also be sharply lower. Under unabated and relentless demand-side pressures, any sustained improvements in supply will impact prices for most grades of printing and communication papers.

Second, especially for BEK pulp and in fact, hardwood pulps in general, we expect new capacity to come online in South America by the end of the year. That very efficient additional supply will be cheaper and lower on the cost curve than most equivalent pulp produced in China.

Third, by the middle of 2023, there will be additional Chinese pulp capacity. Not much, not all bleached, but more pulp.

Albeit global markets remain on the upside for prices, downside pressures are not far distant.