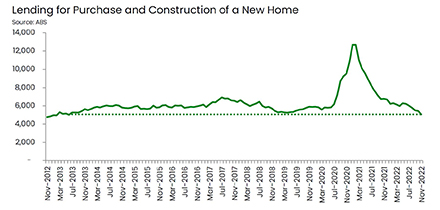

There were only 5,057 loans for the construction or purchase of new homes in November, the weakest month since June 2013 according to HIA Economist, Tom Devitt. Source: Timberbiz

The ABS released the Lending to Households and Businesses data for November 2022.

“This reflects the very well broadcast housing downturn, with new housing loans over the 12 months to November 2022 down by 36.2 per cent on the preceding year,” added Mr Devitt.

“Investors and owner-occupiers, alike, are retreating from the market.

“This contraction in lending occurred before the RBA increased the cash rate in December and we expect an ongoing decline in lending as the full impact of the increase in interest rates flows through to households.

“There are long lags inherent in this cycle and the full impact of the increase in the cash rate in 2022will not be observed until late in 2023.

“The RBA has already undertaken the steepest hiking cycle in a generation, and it needs to hold fire on further hikes to give their actions to date time to play out.

“The RBA will not restore the economy to stable growth by putting the building industry through boom-and-bust cycles.

“As building activity slows in 2023, the RBA will be under increasing pressure to reverse course in the second half of this year,” concluded Mr Devitt.

The number of loans for the construction or purchase of new homes declined in all jurisdictions in November 2022 compared with the same month in 2021, led by the Northern Territory (-58.3%), and followed by the Australian Capital Territory (-39.7%), Queensland (-30.8%), Western Australia (-30.3%), South Australia (-29.7%), New South Wales (-26.8%), Victoria (-15.2%) and Tasmania (-7.4%).