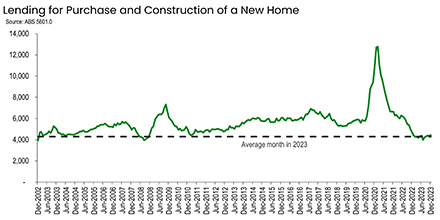

There were just 51,570 loans issued in 2023 for the construction or purchase of a new home, less than half the number of loans issued just two years earlier in 2021. Source: Timberbiz

The ABS released the Lending to Households and Businesses data for December 2023 on Friday, which provides statistics on housing finance commitments.

“The ABS has been collecting data on lending for new homes since 2002, and today’s data shows the lowest number of these loans being issued on record,” HIA Senior Economist Tom Devitt said

“The steepest RBA rate hiking cycle in a generation has compounded the elevated costs of home building, seeing potential home buyers squeezed out of the market and fewer new homes commencing construction.”

This lack of new work meant the pipeline of new housing supply approaching completion was now shrinking rapidly.

“At this rate, Australia will not commence enough housing to meet National Cabinet’s target, falling well short of the 1.2 million new homes they want to see built in the next five years,” Mr Devitt said.

The latest ABS data reinforced the need for immediate action by Governments to improve planning regimes, reform taxes on housing, release more shovel ready land, reduce red tape, and address skilled worker shortages.

“These are some of the key measures needed to increase the construction of new homes and support the industry to build more of these much-needed homes,” Mr Devitt said.

“At a time of record population growth and acute shortages of rental accommodation, a dwindling supply of new homes threatens to worsen Australia’s housing crisis.

In original terms, the total number of loans issued for the construction or purchase of new homes in 2023 declined in all jurisdictions compared to the previous year, led by the Australian Capital Territory (-51.4%) and followed by the Northern Territory (-33.5%), Tasmania (-31.0%), New South Wales (-30.9%), South Australia (-27.1%), Victoria (-26.2%), Queensland (-21.8%) and Western Australia (-15.6%).