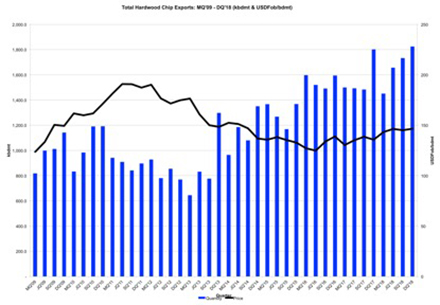

Australia’s hardwood chip exports lifted to a record 1.824 million bone dried tonnes (bdmt) in the December quarter, feeding into a new annual record of 6.666 million bdmt for the full year 2018. At the same time, the quarterly average export price rose to a four-year high of USD146.52/bdmt on a free-on-board basis, according to IndustryEdge’s latest analysis. Source: Timberbiz

The market analysis and consulting firm’s latest data report was released to clients earlier in the week, detailing all of Australia’s woodchip, log and sawnwood trade movements for 2018.

“Last year, 2018 was the biggest year ever for Australia’s hardwood chip exports,” Tim Woods, managing director of IndustryEdge told Daily Timber News.

“We expected 2018 exports in would be close to the previous year’s record, but thanks to the December Quarter, exports for the full year were up 6.2% on the previous year.”

Mr Woods focussed in on the second half of 2018, saying that the September quarter saw exports total 1.733 million bdmt. Alongside the 1.824 million bdmt exported in the December Quarter, exports in the second half amounted to 3.557 million bdmt.

“We keep saying this, but it is quite difficult to see how the supply chain could pump out any more hardwood chips,” Mr Woods said. “But each year, the supply chain, from the coupe to the harvest and haulage contractors, the chip mills and the export facilities, keep finding ways to pump out more volume.”

As an example, Mr Woods explained that in 2018, 79 woodchip export vessels passed through Portland in Western Victoria alone.

“Our vessel tracking and reporting system shows 79 woodchip export vessels went through Portland in 2018,” Mr Woods said. “That includes hardwood and softwood shipments, but at just over 1.5 vessels per week, that is an efficient supply-chain.”

Portland may be the largest export facility, but as IndustryEdge’s reporting demonstrates, others are also pushing out large volumes.

“The three Bs – Bunbury, Burnie and Bell Bay – all had big years too,” Mr Woods said.

There do not appear to be any storm clouds on the horizon, with respect to export volumes, according to Mr Woods, but the price growth of the last year is unlikely to be repeated in 2019.

“We saw average export prices increases around 8.1% from the December Quarter of 2017 to the December Quarter of 2018, in US dollars,” Mr Woods said. “There are still upwards price expectations, but they are unlikely to be as large in 2019 as they were previously.”

Deliveries to China were up 7.9% in 2018 but down 2.5% to Japan, a further indication of the importance of the Chinese market, as well as the significance of maintaining a diverse supply into the global market for hardwood chips.

Every month, IndustryEdge publishes Wood Market Edge, Australia’s only forestry and wood products market and trade analysis, and supplies its customers with hundreds of unique data products, advisory and consulting services.

Find out more at www.industryedge.com.au