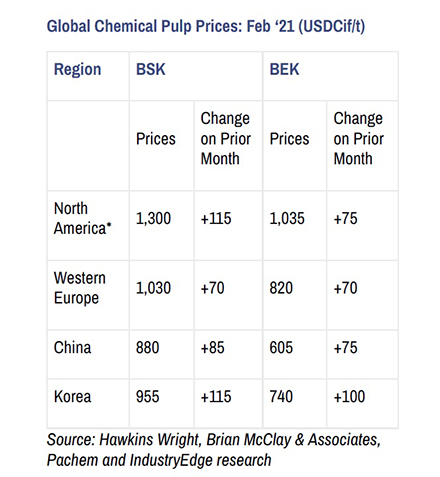

Global pulp prices continued their rocket-paced growth in February, with all indications that March is proving to be similar. In the main Chinese bleached softwood kraft (BSK) market, the average price lifted to USD880/t, fuelled by soft inventories, some supply constraints and solid demand. Source: IndustryEdge

Expectations are for continued rises, with Hawkins Wright reporting the May futures price for BSK pulp at around USD985/t. Meantime, the price of bleached hardwood kraft (BHK) pulp lifted to an average USD605/t, up 14% on the prior month.

To the end of February, average pulp prices had lifted more than 29% for BSK pulp and almost 25% for BHK pulp.

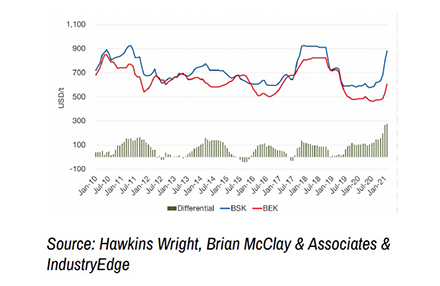

As the chart shows, the spread between BSK and BEK has widened to an historic high of USD275/t on average. That is entirely unsustainable, and we continue with the view that this will result in higher BEK prices, before any possible reduction in BSK prices.

There is no doubt that fibre shortages linked to China’s recovered paper import bans are playing into pricing right now. That seems set to continue as supply lines and pricing structures rebalance.

Growing Chinese industrial production, to supply both local demand and global markets – especially for packaging and tissue materials – is clearly a driver for the continued price growth.

While welcome in many respects, the pulp price rally does appear to be following global commodity price trends. As markets settle, supply disruptions dissipate over time and vaccination program return the world to some level of ‘normalcy’, febrile pulp price movements will become less likely.

IndustryEdge continues its expectation that pulp prices will stabilise in the June quarter, but only after reaching record prices.