The latest softwood chip export data from Australia demonstrates that the resource is under significant pressure. There are other sectoral pointers. If there is a grade of paper or paperboard in which Australia has real global muscle, it is virgin Kraftliner, manufactured from the residues derived from Australia’s softwood plantation estate. Source: Timberbiz

The latest softwood chip export data from Australia demonstrates that the resource is under significant pressure. There are other sectoral pointers. If there is a grade of paper or paperboard in which Australia has real global muscle, it is virgin Kraftliner, manufactured from the residues derived from Australia’s softwood plantation estate. Source: Timberbiz

The simple story is that the nation’s softwood plantations (mainly Pinus Radiata) provided sufficient woodchips – in addition to saw and peeler logs – that became the feedstock for production of strong virgin liners for corrugated boxes.

Two large integrated kraft pulp mills produce Kraftliner based on this resource. In addition to supplying local markets, Visy’s Tumut and Australian Paper’s Maryvale mills both engage in export of Kraftliner. Without overdoing it, everything the Australian mills can produce would easily be taken up in the global market.

Population growth in Australia (among other factors) has increased demand for sawn timber and for packaging. That is also a global story.

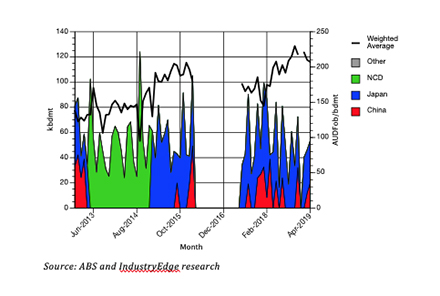

As the first chart shows, Australia’s softwood chip exports are on the slide. At 583.3 kbdmt (bone dried metric tonnes), those exports are not insignificant, but they are more than 14% lower over the year-ended April 2019, than the prior year. At an average AUDFob207.18/bdmt in April, export prices are good, although less so for sellers denominating their transactions in US dollars, of course.

Australian Softwood Chip Exports by Country: Dec ’12 – Apr ‘19 (kbdmt & AUDFob/bdmt)

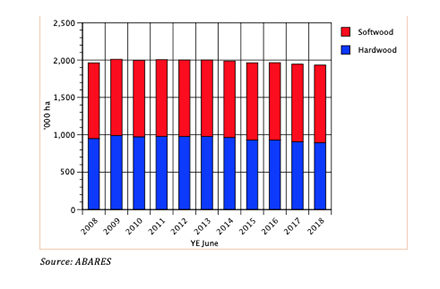

The headline export data might well be the canary in the mine on available softwood chip resources. In Australia, the softwood plantation estate has been static for 20 years at around one million hectares.

The second chart shows the details.

There are substantial efforts underway to increase that estate, but any new plantations are literally decades from yielding more wood.

Australia’s Plantation Estate by Species: 2008 – 2018 (Hectares)

Growing the Australian plantation estate

The Australian forestry and wood products industry has called repeatedly for an increase in the national plantation estate. In 2018 that worked its way through the ‘lobby train’ and plantation growth was included in the Federal Government’s National Forest Industry Plan 2018.

The ‘billion trees’ initiative is yet to be given its full flourish, but that is underway.

At the May Federal election, the now re-elected Morrison Government announced the establishment of an AUD500 million concessional loan arrangement to be managed by the Regional Investment Corporation. By its own assessment, the Government considers that may support 150,000 hectares of new plantations, with the target intended to be “…support for the purchase of the land (the largest cost).”

Future direction for softwood chip exports

While the nation waits for its plantation base to grow, IndustryEdge’s expectation is that softwood chip exports will contract, as the domestic demand pressures for softwood fibre grow. To be clear though, there is not enough resource in Australia, leave alone in a specific wood basket, to support a new softwood kraft pulp mill. It is doubtful there is sufficient to support investment in a net expansion.

So, over time, as local demand increases, exports of Kraftliner will inevitably decline. We observe that is already occurring. In the short-term, that will create few issues, but over the longer term, once the exports are repatriated, how will additional supply be secured? If grown for saw logs, new softwood plantation resources will take around 30 years to mature and will provide no significant additional supply for at least a decade after they are planted.

The implication is significant for countries that together are almost entirely self-sufficient for their fibre packaging needs.

Softwood chip exports are singing like a canary right now.