The first increase in the cash rate in May 2022 is yet to adversely impact employment in home building and further rate rises risk a deeper and more prolonged downturn, according to HIA Chief Economist Tim Reardon. Source: Timberbiz

The Australian Bureau of Statistics released its monthly and quarterly data for the consumer price index, including statistics about price change for categories of household expenditure.

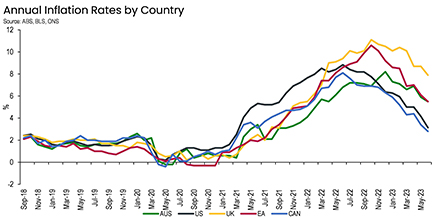

Australia’s inflation rate declined from its 2022 peak of 7.8% to 6.0% in the 2022/23 financial year, including a 0.8% increase in the June Quarter 2023.

The cost of home building materials, which was the main driver of Australian inflation during the pandemic, has also facilitated the decline in inflation. Last year, this component represented more than a quarter of headline inflation in Australia. This year, it represented barely more than a tenth.

Mr Reardon said that further declines were likely in the coming quarters as the volume of work under construction slows.

“One in 10 Australians are employed in the home building industry and it is not until the rise in the cash rate causes building activity to slow, that the impact of the RBA’s actions will be evident in employment figures,” he said.

“In May 2022, when rates started to rise, there was a record volume of building work in the pipeline. Even after 14 months of rate increases, this volume of work remains well above pre-pandemic volumes and is likely to stay elevated until at least early 2024.”

He said that this large volume of work had obscured the adverse impact of rising rates on the building industry and on the wider economy.

“This has led to rates rising faster and higher than necessary.

“Sales of new homes have fallen sharply since the first increase in the cash rate with the first half of the year 41.8% lower than at the same time last year.

“A more accurate reflection of the downturn that is underway is to make a comparison with sales from 2019, which was a year with very modest levels of building activity,” he said.

“Sales of new homes in the first half of 2023 were 26.2% lower than at the same time in 2019.

“This slowdown has now become evident in official data with loans for the construction and purchase of new homes down by 31.1% over the year. Building approvals have started to fall and are now 13.5% lower than at the same time last year.”

Mr Reardon said that given the long lags in this cycle, the rise in the cash rate in May 2022 was now set to become evident in a slowdown on building activity on the ground.

“We forecast that in 2024, the number of new homes commencing construction will reach its lowest volume since 2012, when the RBA last increased the cash rate significantly.

“This will also be one of the lowest volumes of new home starts in the past 30 years. This is contrary to the Australian government’s goal of building more than one million homes over the next five years.”

Despite this, there were still over 100,000 houses under construction around the country, almost double the number that existed before the pandemic. As builders completed this large volume of work over the next six to 12 months, the full impact of the rise in the cash rate would become evident on employment and, therefore, on the wider economy.

“Combined with employment growth in other sectors, this explains why unemployment across Australia has remained so low, over a year after the RBA commenced the sharpest tightening cycle in a generation,” Mr reardon said.’

“Unemployment will remain low until we see these more marked declines in on-the-ground activity.

“The moderation in inflation in today’s data reflects actions taken around the world over the last year to address pandemic-era supply constraints. In Australia’s case, this has especially related to the imports of fuel and building materials. This is why inflation in Australia has declined consistent with other major economies.

“In pursuing a reduction in inflation by using monetary policy, the RBA needs to ensure that these deep and treacherous lags are fully appreciated as every additional interest rate increase will deepen the coming trough of building activity, and employment in the sector, with little effect on speeding up Australia’s return to its 2-3% inflation target band,” he said.