The global woodchip trade is dominated by hardwood chip movements, with Asian nations – especially China – the major recipient. There are pressures in the Chinese economy, many of which were experienced in the last year. Yet, for all the noise, China received 18.8% (2.78 million bone dried metric tonnes [bdmt]) more hardwood chips in 2022 than it received the prior year. Source: IndustryEdge

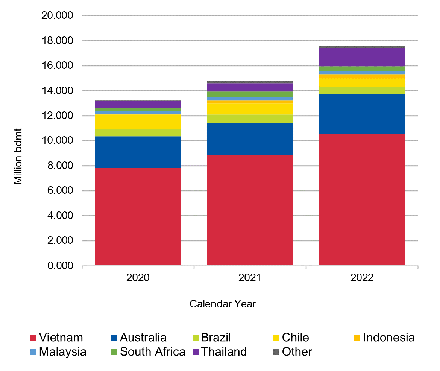

Shipments from Australia bounded 25.8% higher to hit 3.175 million bdmt (up 0.650 million bdmt), but the really outstanding lift was again from the miracle that is Vietnam. Shipments to China from Vietnam lifted 1.646 million bdmt or 18.5% to a massive 10.532 million bdmt for the year.

It is important to keep in mind that Vietnam is equally as dominant in hardwood chip supply to Japan. Its total shipments to the world exceeded 15.1 million bdmt in calendar year 2022. Australia’s shipments were less than one-third that total.

There are no indications of supply from Vietnam slowing, though endless growth is simply not possible. The greater likelihood is that Chinese demand falters at some point, though that too seems some way off.

It is noticeable that Chile’s supply is reducing consistently, even as Thailand’s is growing. In Chile’s case, the better value is to be found in producing pulp and shipping the value-added product to Chinese customers. Chile is important as a direct competitor for Australia – it and Brazil are the other major ‘premium’ (eucalypt) chip suppliers.

For Thailand, the situation is the opposite. It is difficult to manufacture pulp in Thailand, competitively with the big pulp producers in China.

Australia’s place in the total market is relatively secure in the Chinese market, for now at least.

For more information: www.industryedge.com.au