It’s the building boom – or bubble – no one seems to have seen coming. According to Kersten Gentle Frame and Truss Manufacturers Association’s executive officer to say that the housing market boom was not predicted, is an understatement. Ms Gentle said so in an open letter to builders. Source: Timberbiz

“Less than a year ago, the industry was preparing itself to batten down the hatches and almost enter hibernation for the second half of 2020 and perhaps for the first half of 2021,” she said.

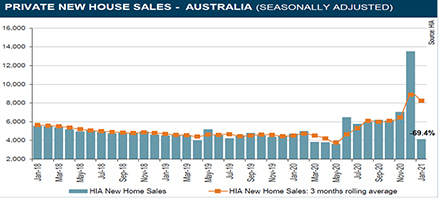

The Housing Industry Association reported this week that the number of loans for the construction of a new dwelling rose for the seventh consecutive month and reached a new record in January.

“Confidence in the housing market has been improving since the announcement of HomeBuilder in June 2020,” HIA Economist Angela Lillicrap said.

“The increase in lending in January coincides with the surge that was seen in HIA’s New Home Sales in December. Households rushed to finalise contracts to build a new home before the end of the 31 December 2020 deadline to access the $25,000 grant.

“The number of construction loans to owner occupiers in the three months to January 2021 is 45.8% higher than the previous quarter and is more than double the same time the previous year.”

The HomeBuilder element is something IndustryEdge has highlighted in a briefing paper for the AFTA.

IndustryEdge said the huge lift in sales “might well have included a bit of pressure selling, a bit of panic buying, and a whole load of one-off stimulus”.

There are two bubbles, according to IndustryEdge.

The first bubble arises because the HomeBuilder stimulus appears to have pushed up house prices across Australia, with the exception of Melbourne, where the pandemic bit hardest and longest.

“But also, we think this bubble in prices is not sustainable because it represents a moment of demand, met by an unforeseen under-supply. People returning home from less desirable locales than Australia are in the market, along with the first home buyers and those churning their existing residence.’

“Each has helped force demand up, and with limited supply, in an open market, prices rise.

“Higher prices in established housing appears to have forced some would be buyers of existing stock, towards the bright lights of the HomeBuilder stimulus, which was attractive enough as it was.

“That in turn forced up the number of sales – leading to subsequent approvals – and in our view, that is another bubble.”

IndustryEdge says that if Australia is lucky, the bubble will subside, rather than burst.

“That would be good news, because it would allow for an orderly adjustment to normal levels of building activity, provide time for supply chains to respond and reduce the heat in the overall market.

“We can hope for that to occur, but the risk of the bubble bursting is relatively high and the consequences could be quite serious.”

In her letter to builders, Ms Gentle said that no industry was sufficiently prepared for increases this dramatic or sudden.

“Timber prices have increased, as have prices for all building materials, costs have soared for shipping and transport and with the housing boom combined with record renovations, we are seeing the demand for all building materials stretched across the supply chain,” she said.

“FTMA understands that the pressure on all products, including the shortage of skilled trades, is pushing timeframes out longer than builders and developers would like.

“However, you can be assured the industry is working as hard as possible to supply our engineered quality products as soon as possible.”

Across the states, the number of loans to owner-occupiers for the construction of a new dwelling in the three months to January 2021 compared to the same time last year has tripled in Western Australia (+221.7%) and more than doubled in Queensland (+164.9%), the Northern Territory (+160.3%) and Tasmania (+104.2%). Victoria (+97.1%), the Australian Capital Territory (+87.4%), South Australia (+82.6%) and New South Wales (+72.9%) also recorded strong results.