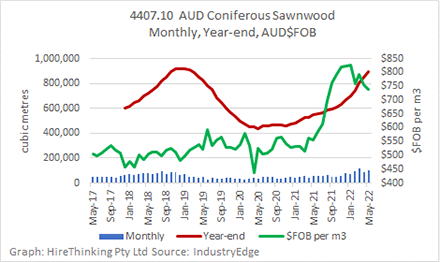

Australia’s imports of sawn softwood rose an astounding 62.2% year-ended May 2022, lifting to 895,314 m3 for the full year. While weighted average import prices may have peaked in January, there is very real prospect that annualised imports will continue to grow in coming months. Source: FWPA

Australia’s imports of sawn softwood rose an astounding 62.2% year-ended May 2022, lifting to 895,314 m3 for the full year. While weighted average import prices may have peaked in January, there is very real prospect that annualised imports will continue to grow in coming months. Source: FWPA

One factor that could sway the continued growth in imports is Russia’s war on Ukraine. The evident tightening in global wood fibre markets is likely to begin having an impact for supply delivered around August and after. To date, the extent of that tightening on Australian markets has been unclear and we expect will remain that way for some months.

Meantime, importers have responded magnificently to the rapid growth in demand, delivering a huge volume of imports and ramping up their supply in very short order, as the chart below shows.

The only factor that grew faster than import volumes were weighted average import prices, which lifted sharply through 2021 to peak at AUDFob827/m3 in January 2022, before declining more recently to AUDFob739/m3 in May 2022.

As the chart above shows, the latest pricing is just a moderation of prices that are massively higher than they were over most of the recent past.

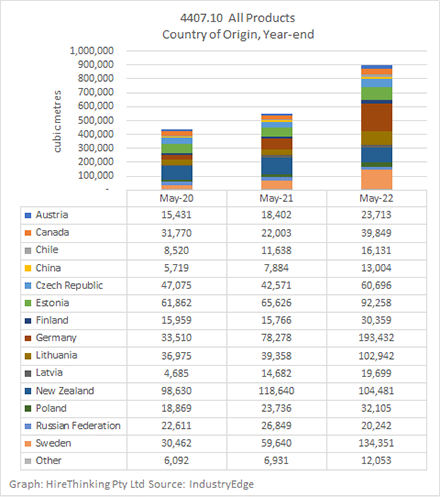

A large number of countries provide softwood products to Australia. As we can see below, seven of them experienced very large increases over the last year, and in fact, over the course of the pandemic. Whether all this is sustainable remains to be seen, especially as the big increase from Germany is understood to be related to salvage harvesting.

Looking beyond Germany, supplies from Estonia, Lithuania and Sweden all stand out. Though all are elevated on the prior year, those supplies are linked to major and ongoing supply lines and appear broadly sustainable, should demand in the market support them.

Overall, it is five specific grades that provide the vast bulk of the growth in imports.