Latest log export data for Australia and New Zealand tells two radically different stories. New Zealand’s log exports are booming and the price is at record levels. Meantime, Australia’s trade is constrained on both fronts, despite the strength of global demand for fibre. Source: IndustryEdge

Latest log export data for Australia and New Zealand tells two radically different stories. New Zealand’s log exports are booming and the price is at record levels. Meantime, Australia’s trade is constrained on both fronts, despite the strength of global demand for fibre. Source: IndustryEdge

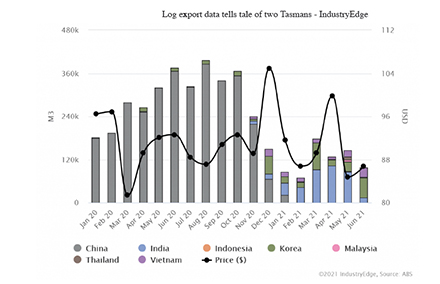

As the data and visualisations on the Wood MarketEdge online platform demonstrate, in June 2021, Australia’s total softwood log exports reached just 98.3km, the lowest export volume in five months. The average price was AUDFob114/m or USDFob85/m. The main recipient country for the month was Korea(54.6 km), followed by Vietnam and India.

The contrast of Australia’s log export market with that of New Zealand could not be more stark.

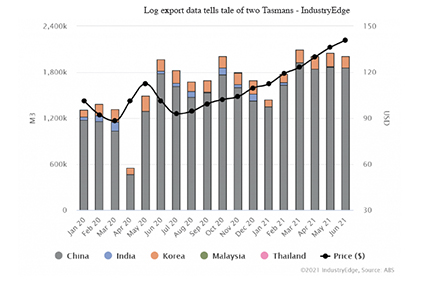

In June 2021, New Zealand’s exports of softwood logst otalled 2.058 million m, consistent with the prior two months. The average export price was NZDFob199/m or an eye-watering USDFob141/m.

The destination of New Zealand’s logs remains China first, Korea second and that is about it.

This contrast in log exports, driven largely by bubbling trade and diplomatic tensions between Australia and China, could hardly be more stark. Both volumes and prices appear to favour New Zealand.

That is true by the measure of exports of raw wood, but whether the same can be said from an economic development, value-adding, employment and sovereign self-sufficiency perspective is an altogether different matter.

Challenges in exporting logs from Australia have enlivened numerous considerations about local processing options on the one hand, and the risks of dependency on another country’s sometimes quixotic expectations of the attitude and expectations of its trading partners. New Zealand’s log exporters are ‘filling their boots’ right now, but the Australian situation demonstrates they too are ultimately exposed to the whimsy of their main customer.