The US sawn lumber market is in a process of change that has implications for the global lumber market and could impact supply into countries like Australia, according to latest analysis by Forest2Market. Although the US housing market is softening, the impact of extensive tariffs on sawn lumber imports from Canada (averaging around 21%) cannot be under-estimated. Source: IndustryEdge for Timberbiz

As Forest2Market wrote:

“…those tariffs are rearranging the global supply chain; producers in the US South have increased capacity and exporters from overseas have filled any gaps in the market.”

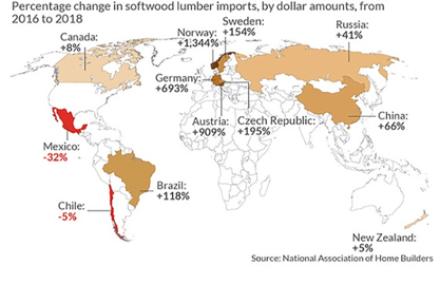

As the info-graphic shows, on a value basis, sawn lumber imports to the US have altered significantly from 2016 to 2018.

It is important to note that some of the extreme increases in value (Norway is the stand-out) come off a very low base and are barely relevant.

Because the information is based on value, it is important to note Forest2Market’s advice that:

“While Canada’s dollar share of softwood imports increased 8% in 2018, its total share of softwood imports is down. For the 10-month period through October 2018, total softwood lumber imports from Canada were down nearly 3%, while European imports were up nearly 71%.”

What is more, British Columbia (BC) alone exported 8% less lumber in October 2018 versus the same month in 2017.

But the market dynamics go further, as Forest2Market explains:

“BC will likely reduce capacity by 1BBF [billion board-feet or approximately 2.360 million m3] in 2019, which will be offset by increased capacity in the US South that will marginally affect supply. Many of Canada’s top producers are already manufacturing lumber in the US South to take advantage of cost benefits while remaining competitive in the global market.”

The example most cited is Canfor’s USD120 million state-of-the-art softwood lumber mill in Washington, Georgia. The facility will open late 2019 and will have a production capacity of 275 MMBF [million board-feet or approximately 648,900 m3] and will employ best-in-class mill technologies.

An estimated – and mind-bending – 6 BBF [14.158 million m3] of additional capacity is forecast to come online in the US South by the end of 2020. This includes both greenfield mills and newly-rebuilt/refurbished facilities, most of which reportedly include lower manufacturing costs.

So, how does this impact supplies into Australia?

We see it like this. If US housing remains sluggish – and Forest2Market thinks it will until around 2021 – the expansions of the US South will force at least some of the imports out of the US market.

Given the prominence of European producers in the Australian sawn softwood import market, it seems reasonable to anticipate that there will be more volume seeking to enter the domestic market, potentially right at the time when the Australian housing market is itself softening.

Every month, IndustryEdge publishes Wood Market Edge, Australia’s only forestry and wood products market and trade analysis, and supplies its customers with hundreds of unique data products, advisory and consulting services.

Find out more at www.industryedge.com.au