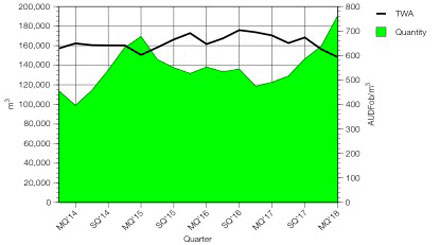

The chart shows the volume of dressed sawn softwood imports, which is where almost all of the growth has occurred, according to the IndustryEdge analysis team

Imports of sawn softwood topped 854,000m3 over the year-ended March, according to trade and market experts IndustryEdge. Source: IndustryEdge for Timberbiz

The rise in imports was almost 16% or more than 116,000m3 higher than a year earlier, and defying expectations from 2017 that imports would soften as the Australian housing market weakened.

“Some of our domestic producer clients are looking closely at imports now. A year ago they expected the total market to soften, at least a little. That has not eventuated and it doesn’t seem likely it will,” Tim Woods from IndustryEdge told DTN.

Australia’s housing approvals continue to be quite stable, especially free-standing houses and townhouses, that use most of Australia’s sawn wood products.

As DTN discusses regularly, the ‘family’ element of Australia’s housing market continues to be strong, even experiencing growth while the total market declines.

“We can see the market for sawn softwood continuing along at about the same level for the next year or more,” Mr Woods said. “The driver for that is fairly consistent housing approvals.

“Unless something changes, like a sharp rise in the value of the US Dollar or the Euro, or new capacity domestically, the imports will continue and could still grow. We don’t see any of those scenarios on the horizon, so expectations of persistently strong imports are probably right.”

IndustryEdge points to import growth from all major supplier countries, except New Zealand, which appears to be operating to a similar demand situation to Australia.

“Over the last year, to the end of March, imports of the dressed softwood grades, so especially the structural grades used in framing, have increased strongly,” Mr Woods said. “Shipments from European countries were up more than 50% over the year and totalled over 331,000m3. They accounted for almost 53% of all of our dressed sawn softwood imports, up from 43% just a year ago.”

IndustryEdge says the strength of the US housing market over the last year has reduced the volume of wood available from North America, leaving the European suppliers with improved opportunities in the local market.

The value of the imports over the year was almost $510 million, which represents an increase of almost 11% on the year earlier.

“Import prices are, on average, lower than a year ago. There is no strong reason for prices to be low right now, so our clients are watching the detailed country-level data we supply pretty closely,” Mr Woods said.

Wood Market Edge is available for subscription, and is also provided on a complimentary basis to subscribers to the monthly wood products trade data series, which includes Woodchip Export, Log Export and Sawnwood Import and Export data.

Visit www.industryedge.com.au