Last week’s ‘rush to retail’ by consumers in South Australia was a reminder of the time earlier this year when much of the nation was engaged in the panic buying game. Nowhere was this more obvious or remarked upon than in supplies of toilet paper. Source: Industry Edge

Despite the supply chain holding up in the nationwide lockdown, there was no standing in the way of SA consumers. They did their best to empty the shelves once again. It seems the psychology is not so much concern about a supply chain failure, but rather, a lingering worry that other people will panic and buy up all the supply. Which causes the consumer to… panic and buy up all the supply.

So, this last week, the supply chain sighed, then cracked on with ensuring that extra shipments were delivered where they were needed. Production continued and was ready to ramp up at a moment’s notice. Because just like earlier this year, that’s what quality manufacturers like ABC Tissue, Encore Tissue, Kimberly-Clark Australia and Solaris Paper/The Sorbent Paper Company do.

But earlier this year, the national supply chain copped an absolute thumping. So much so that apparent consumption of tissue products (including toilet paper) lifted a whopping 17.5% compared with the prior year. As IndustryEdge reports in the 2020 Pulp & Paper Strategic Review, that figure was inflated because consumers effectively shifted large amounts of inventory from the supply chain, to their closet, garage and even it seems, their spare room. Apparent consumption will fall back in this current financial year as that inventory washes its way through the economy.

One way the supply chain replenished, was to rely more on imports of tissue stock (for local

conversion) than ever before. Imports have long been a feature of the tissue industry but rose 15.6% on the prior year, accounting for a record 38% of total consumption.

But more than that, imports of pre-converted (ready to sell) tissue products rose 40.6% in 2019-20, compared with the prior year.After the surge, imports returning to ‘normal’

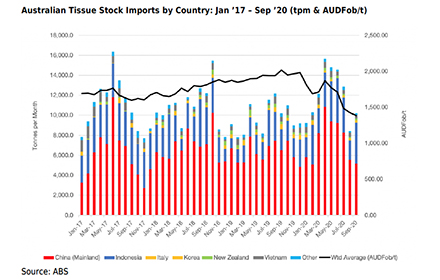

As the chart shows, imports of tissue stock leaped to near record monthly levels in April, reaching 15,650 tonnes, since when they have corrected, to 10,040 tonnes in September.

It is difficult to escape the importance of supply from China into the market across all time periods, but in particular, its role as the main supplier of the ‘flex’ volume required to supplement local supply when households went about building those personal inventories. The other supplier of significance is nearby Indonesia. Year-ended September, annual imports were still up 15.1%. This was marginally lower than the record set year-ended June 2020.

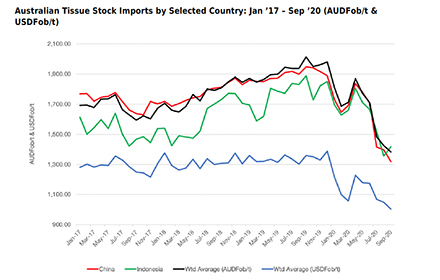

The real interest may lie in the average import price. In a period of sustained over-demand and some rapid actions being taken to ensure supply-chains were replenished, prices should go up right? Not on this occasion.

As the chart shows, prices have declined steeply for most of 2020.