Global shipping indices have been relatively stable over the last month, with the slowdown in Chinese finished goods exports (linked to the trade war with the US), flowing on to some bulk materials. Source: IndustryEdge for Timberbiz

Uncertainties surrounding Brexit also appear to have flowed into caution around vessel bookings, with the EU confirming in late March that vessels from the UK would be subject to the full complement of non-EU inspection and other regulatory requirements, once Brexit is completed. Though it appears Brexit has some distance to go, the potential implications are clearly weighing on the market.

There are further costs to be borne by importers, associated with the now depressingly annual Brown Marmorated Stink Bug season.

We are advised that the global Low Sulphur Fuel Oil (LSFO) provisions due to commence 1 January 2020 are well advanced, but that negotiations as to increased shipping costs are not finalised. An Australian freight forwarder advised they have encouraged clients to budget for an additional USD160 – USD200 per TEU (twenty-foot equivalent unit).

Shippers are proposing different mechanisms to recover higher fuel costs, but essentially propose to ‘distance weight’ the additional fuel costs in a surcharge levied per TEU. Most shipping lines are retro-fitting scrubbers to old vessels, using LSFO where possible and commissioning new vessels operating on natural gas.

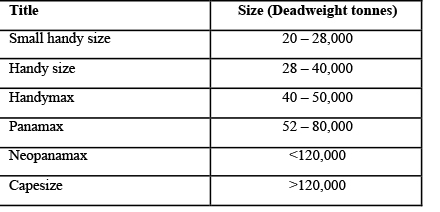

It is therefore little surprise to learn there have been no sales of Capesize vessels since November 2018, with offered prices around 20% lower over the period. One reason for this is the collapse of the dam at Vale’s Brazilian mine in late January, which will significantly decrease demand for vessels.

As the table below shows, Capesize vessels are the largest of the dry cargo sizes, capable of traversing the southern hemisphere’s Capes to move across the oceans, and unable to travel through the Panama Canal.

Every month, IndustryEdge publishes Wood Market Edge, Australia’s only forestry and wood products market and trade analysis, and supplies its customers with hundreds of unique data products, advisory and consulting services. Find out more at www.industryedge.com.au