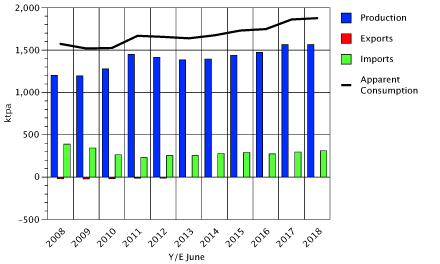

Australia’s total pulp production was a record 1.565 million tonnes in the last financial year, contributing to the local wood supply pressure. A rise of just 1000 tonnes on the prior year, over the last decade, Australia’s pulp production has risen around 2.7% per year, according to IndustryEdge.

The constant demand for pulp wood by local producers, as well as for sawn wood and wood panels, in addition to the strong demand for Australian hardwood chips and softwood logs.

“Just three companies, and really just in three regions in Australia, make all of the local pulp,” Tim Woods from IndustryEdge said.

“Australian Paper in Victoria, Visy in New South Wales and Norske Skog at two mills, one in New South Wales and one in southern Tasmania.”

IndustryEdge says that a small proportion of the pulp is recycled, but that more than 92% is made from virgin fibre, supplied from local softwood and hardwood plantations and from native forests.

“All four of Australia’s operating pulp mills use softwood chips,” Mr Woods said. “But only one has a significant hardwood intake – Australian Paper’s Maryvale mill in the LaTrobe Valley.”

Using a model that the firm has been refining for the better part of three decades, Woods says they can provide an early assessment of the amount of wood fibre delivered to the nation’s pulp mills.

“Our estimate is that in 2017-18, wood suppliers across the country delivered 5.439 million green metric tonnes of wood to Australia’s pulp mills,” Mr Woods said. “That is actually down a little on the year prior, but not noticeably.”

In some respects, the most important point the latest work by IndustryEdge demonstrates is that there are multiple points of pressure on domestic wood supply. Hardwood chip exports were at record levels, as were softwood log exports.

Output from the nation’s sawmills was stable, and near record highs, while imports of sawn wood ands panel products (particleboard, MDF and plywood) are also at or near record levels.

“Of course, the local wood supply chain is under pressure,” Mr Woods told Timberbiz. “New plantations and production expansion are lagging population and consumption growth. The total market consists of all of these elements and each is under different pressures right now.

“What the pulp data shows is that there is a stable and gradually growing market in some key regions, for residues, that can help sustain expansions of plantations and solid wood production. Without the pulp mills, some solid wood production investments simply would not be viable.”

Pulp imports rose slightly in 2017-18, but accounted for less than 17% of total pulp used for the year. All the imports are used to make toilet paper and facial tissue products.

“If we got the wood supply lined up with the pulp production, Australia could become even more self-reliant for pulp in the future,” Mr Woods said.

IndustryEdge’s 2018 Pulp & Paper Strategic Review – the 27th consecutive annual edition – is available for subscription from www.industryedge.com.au.