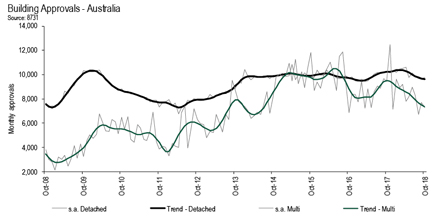

ABS data released shows that a total of 17,070 homes (seasonally adjusted) were approved for construction in the month of October 2018, 1.5% fewer than in the previous month and 13.2% fewer than in October 2017. The monthly decline in total approvals was driven by multi-unit homes, which declined by 5.4%, while detached house approvals increased by 1.7%. Source: Timberbiz

However, new home building held up well during the September 2018 quarter despite the tougher market conditions, according to Master Builders Australia’s Chief Economist Shane Garrett.

“… ABS figures on Construction Work Done indicate that new residential building work eased back by 1.8% during the (September) quarter but was still some 4.7% higher than a year earlier.

“Surprisingly, the apartment/unit side of the market put in a strong performance and came close to surpassing its busiest quarter on record. Work on detached houses fell by 3.2% compared with the previous quarter,” Mr Garrett said.

“The performance of residential building has proven more resilient than expected in light of the unfolding credit crunch and less favourable conditions in Australia’s largest housing markets,” he said.

“Going forward, we do expect the tougher financial environment to take its toll on the volume of new home building over the next few years. Larger apartment projects will probably see the biggest reduction.”

Non-residential building declined by 2.4% during the September 2018 quarter and engineering construction fell by 4.5%.

“With the federal Budget set to be delivered earlier next year, it is important that it includes measures to support our sector’s capacity to meet the building needs of a steadily growing population,” Mr Garrett said.

On the results from October Diwa Hopkins, HIA Economist said that with housing finance increasingly difficult to access and home prices in Sydney and Melbourne continuing to decline, the flow of new homes being approved for construction continues to recede.

“While APRA’s restrictions were designed to curb high risk lending practices, ordinary home buyers are now also experiencing delays and constraints in accessing finance,” she said.

“A credit squeeze has emerged in the latter of half 2018 and this is playing a major role in slowing the flow of new home building work entering the pipeline.

“Households who are seeking to buy new homes are often not receiving sufficient finance, while for those who do receive adequate financing, it now takes much longer to reach that milestone.

“A downturn in new home building has long been anticipated. The current credit squeeze however risks the pace and magnitude of the decline developing into something faster and greater than expected. This would result in a greater drag on the wider economy.”

Total seasonally adjusted dwelling approvals in October 2018 fell in South Australia (-17.0%), Tasmania (-3.0%), Victoria (-2.6%), Queensland (-1.1%), New South Wales (-0.5%) and Western Australia (-0.1%).

In trend terms, total dwelling approvals in October fell by 12.5% in the Northern Territory and increased by 0.8% in the Australian Capital Territory.