A sure sign of continued strength in fibre markets, the Australian hardwood chip price rose 3.6% to an average USDFob156.78/bdmt (bone dried metric tonne) in September. The record average price was on softer volumes of 233.1 kbdmt however, shipments to China in the September Quarter totalled 1.051 million bdmt, the second highest quarterly total ever recorded. Source: IndustryEdge for Timberbiz

In what was once the main market – indeed for many years the only market – hardwood chip exports to Japan were 5.4% higher priced, reaching USDFob140.63/bdmt, on 226.9 kbdmt. The spread between the average prices in China and Japan was 11.5%.

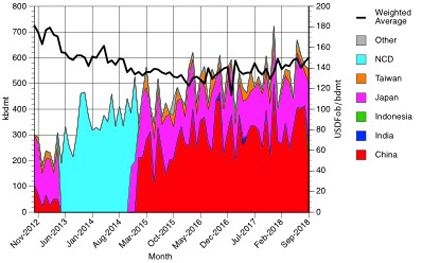

Australian Hardwood Chip Exports by Country(‘000 bdmt & USDFob/bdmt)

Source: ABS, RBA & IndustryEdge

As the chart above shows, Australia’s exports of hardwood chips continue apace, but exports of softwood chips are declining. They totalled just 19.0 kbdmt in September, with quarterly volumes recorded at 148.8 kbdmt, a modest 2.7% higher than the prior quarter.

The average price of softwood chip exports in September (there was only one shipment) was USDFob150.79/bdmt.

Tightness in Australia’s softwood fibre markets has been such that we have anticipated for some time that exports would begin to decline. There have been significant attempts across the Australian industry to ensure the best quality resource is retained and used domestically, where that is viable. We consider it feasible that exports could decline from an annualized approximate 700.0 kbdmt to less than 400.0 kbdmt in the immediate future.

Returning to hardwood chips, the chart demonstrates that as it has clearly become on price, China is now the market leader on volumes of Australian supply. Over the year-ended September, total shipments are up 8.2% on the prior year, totalling a mammoth 6.568 million bdmt, closing in on around 13 million green metric tonnes of wood.

Exports to China accounted for a little more than 61% of the total, rising 8.0% over the year and amounting to 4.037 million bdmt for the year. Once the market leader, exports to Japan accounted for almost 33% of the total, rising 12.8% to 2.162 million bdmt over the year-ended September.

The first shipments to Indonesia were recorded in the September data. This was supply for Asia Pulp & Paper’s giant pulp mill at Oki at the Southern end of Sumatra. The shipment, from Burnie in Tasmania, was 42.3 kbdmt, reportedly at an average price of USDFob193.81/bdmt. That price seems appropriate for a new trade entering into a market where suppliers have the clear advantage.

Hardwood chip trade is a narrow business. There have been no shipments to India in the last year and Taiwan received 397.4 kbdmt from Australia, up 10.1% on the prior year.

Little wonder the diversification opportunity of the trade with Indonesia has been well received in the market.

Every month, IndustryEdge publishes Wood Market Edge, Australia’s only forestry and wood products market and trade analysis, and supplies its customers with hundreds of unique data products, advisory and consulting services.

Find out more at www.industryedge.com.au