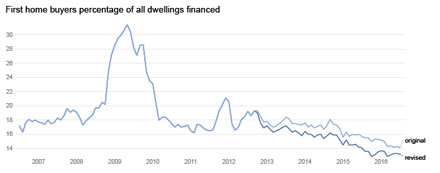

The number of first home buyers in Australia is actually much lower than previously reported, despite already being close to record lows, after the Australian Bureau of Statistics revised key figures over a four year period. Source: ABC News

The ABS said it had worked with the Australian Prudential Regulation Authority (APRA) and lenders to ensure all loans to first home buyers were reported, regardless of whether or not they received a first home owner grant.

“In the process of working with lenders, corrected historical data has been reported by some lenders and this improved data has been used to re-estimate the first home buyer statistics back to October 2012,” the ABS said.

The number of first home buyers, already around record lows, saw numbers drop even lower.

In the original ABS numbers, 14.1% were home buyers in July 2016, but that has been revised lower to 13.2%. The revisions cover a period of between October 2012 to July 2016, and affect estimates for the number of first home buyers and average loan size for first home buyers.

“I think it reinforces what a lot of people think and that first home buyers are really struggling in the market at the moment,” said Cameron Kusher, head of research at CoreLogic.

“It doesn’t surprise me that we’ve got a very low number of first home buyers given where prices are, how high youth unemployment is, how low wages growth is, and the fact that the investor segment, particularly in Sydney and Melbourne, has been so proactive over the last few years.”

Mr Kusher said first home buyers are more active in states including Western Australia and South Australia, but national trends have been driven by Sydney and Melbourne.

“Jobs market is just not very strong in most areas outside of Sydney and Melbourne so people are going to be less inclined to go and take that risk, particularly move to Brisbane or move to Adelaide or Perth if they don’t feel that they can actually go into those markets, move there and find job opportunities,” Mr Kusher said.

According to UBS, Sydney has the fourth riskiest housing market in the world after surging in value over the last three years.

Skyrocketing house prices means young people are increasingly priced out of the market, while statistics show couples over the age of 65 who had invested in the property market are now reaping the rewards, and are considered the richest Australians.

“It has a big impact because most people build the majority of their wealth through residential property,” Mr Kusher said.

“Longer term as well, if people get to retirement and don’t have significant assets, then that means that they cost the government more in social security and pensions.

“The real challenge is if people aren’t in a position to buy property.”