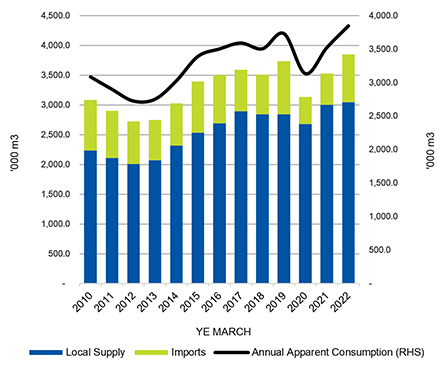

Australia’s consumption of sawn timber for housing and other uses lifted to an all-time high year-ended March 2022. Data released and loaded to IndustryEdge’s Wood Market Edge online platform shows supply of timber continues to work to meet Australia’s huge demand for new houses. Source: IndustryEdge

Consumption of sawn softwood timber rose 9.2% compared with the year prior and lifted to 3.85 million m3. Locally produced sawn softwood appears to be at its peak right now, hovering around 3.05 million m3 per annum over the last several months.

All of the growth has come from imported supply which has exploded over the last year, increasing 53% to a little more than 0.80 million m3. On an annualised basis, imports accounted for 21% of total supply, around 1% higher than the long-term average.

The chart shows Australian consumption of sawn softwood for the last decade, for years ending March.

Demonstrating the strength of demand, imports in March recorded the second highest ever monthly total, with supply mainly from Europe and almost entirely of structural grades to construct houses and other buildings.

The peak of housing approvals may be over, but the long pipeline of work requires a record level of sawn timber now and into the future. IndustryEdge’s demand forecast for sawn softwood was introduced to Wood Market Edge online in late 2021. Since its inception, it calculated March 2022 would be the peak of demand, with 2Q22 being the peak quarter. It was assessed that supply was effectively being rushed to Australia from Europe to meet the largest ever surge in demand.

The lift in monthly imports comes with an important caveat. Shipments have been delayed in trans-shipment ports like Singapore and Hong Kong. With shipping schedules completely unreliable, supply to smaller and distant destinations like Australia has involved ‘batching’ of shipments of goods like timber, with low deliveries one month supplemented by a big shipment in a later month.

Anecdotally, we hear multiple reports from importers, agents and wholesalers that exports from Europe to Australia are slowing quickly.

For more information visit www.industryedge.com.au