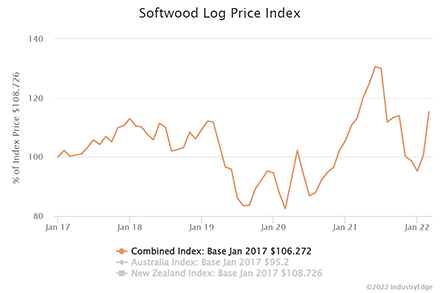

The Australian and New Zealand regional Softwood Log Price Index lifted 14.4% in March, despite deteriorating prices for Australian exports. Source: IndustryEdge

The combined weighted index, based in US dollars, rose entirely due to a 16.1% lift in New Zealand’s export price according to IndustryEdge’s Softwood Log Export Price Index. The index – part of the Wood Market Edge online service – shows Australian weighted average export prices fell 11.8% in March, but on much lighter volumes than exported from New Zealand.

As the chart from Wood Market Edge online shows, the weighted average price is headed back toward record territory, amidst supply chain disruptions and shortly after having come off its all-time highs in mid 2021.

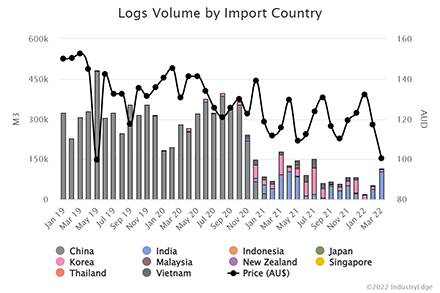

More than 90% of softwood log exports from the Australian and New Zealand cohort are from New Zealand. The vast majority of that supply is shipped to mainland China, the main driver of softwood log prices. Subscribers can download the detailed log export data, available at a port-to-port level, to gain deeper insights into the nature of the trades.

Since late 2020 when China banned imports of Australian logs, the weighted average price of Australian supply headed lower and has subsequently plunged. However, as the chart below shows, the decline in price for Australian supply was already in evidence and was behaving erratically, at least by comparison to the New Zealand supply.

The question posed by one Australian exporter in discussions was whether the pre-ban volatility was a ‘market stress’ test by Chinese authorities as they prepared for the bans.

We will probably never know, but analysis of the data at a ‘port-to-port’ level indicates there were some large movements in key receiving ports from one month to the next.

IndustryEdge’s Australian & New Zealand Softwood Log Export Price Index is updated every month, supporting business-level analysis and providing insights into trade opportunities and challenges.

For more information visit: www.industryedge.com.au